Solectria Celebrates the Extension of the ITC

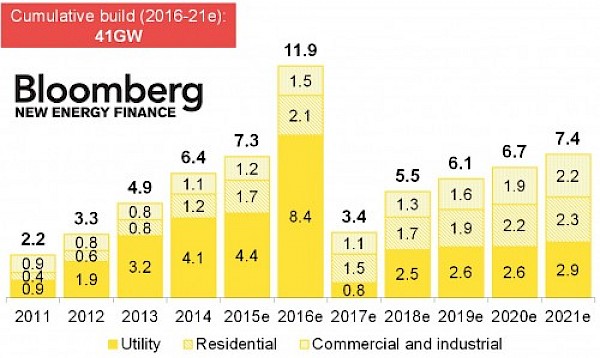

U.S. solar PV with no extension of tax credits for solar, 2011-21e (GW) (graphic source: SolarPowerWorld)

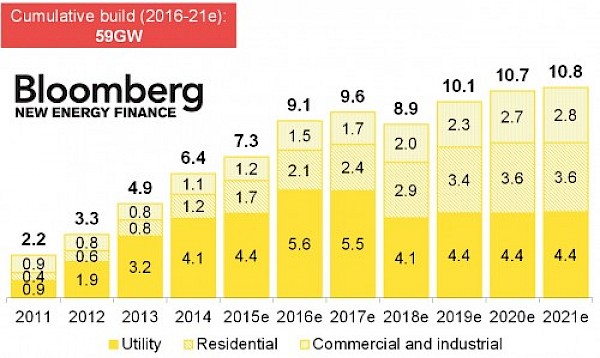

U.S. solar PV with no extension of tax credits for solar, 2011-21e (GW) (graphic source: SolarPowerWorld) U.S. solar installation forecast with five-year phase out of tax credit, 2011-21e (GW) (graphic source: SolarPowerWorld)

U.S. solar installation forecast with five-year phase out of tax credit, 2011-21e (GW) (graphic source: SolarPowerWorld)Along with the rest of the solar industry, Yaskawa - Solectria Solar is celebrating the extension of the Solar Investment Credit (ITC). The extension has allowed us all to breathe a sign of relief and has confirmed what we in the industry already knew: solar is here to stay! This news is great for us, as the second largest commercial inverter supplier in the U.S., and also benefits you, our customers. Extension of the 30 percent ITC for solar installations through 2019 will allow for more installations, more jobs and exponential growth throughout the renewables industry.

Prior to the passing of the extensions, Solectria was gearing up for a record setting 2016 with the looming end of the ITC. We are now ahead of the game with our production planning and more ready than ever to manufacture and ship out GW's of PV inverters to satisfy all of our customers' requirements in 2016.

When planning your solar projects in 2016 and beyond, remember Yaskawa - Solectria Solar is here to meet your solar inverter needs. We look forward to a busy year and to the continued partnership we share with you.

ITC Extension and Phasedown Schedule

2017 - 30 percent

2018 - 30 percent

2019 - 30 percent

2020 - 26 percent

2021 - 22 percent

2022 and beyond - permanent 10 percent for commercial credit

Read what the rest of the solar industry has to say about the ITC extension.

Solar ITC officially extended through 2021

December 18, 2015 | Kelly Pickerel

Original article - Solar Power World

It’s official: The U.S. solar industry will not fall off a cliff come 2017. The U.S. Congress agreed on a bill that extends the solar investment tax credit (ITC) by five additional years, as part of a $1.15 trillion spending bill.

As summarized by research firm IHS, key details of the extension include:

- The ITC will be extended from Dec. 31, 2016, and instead stepped down from 30% to 10% until 2024. Projects that start construction by 2019 will receive the current 30% ITC, while projects that begin construction in 2020 and 2021 will receive 26% and 22%, respectively. All projects must be completed by 2024 to obtain these elevated ITC rates.

- For residential photovoltaic (PV) systems, a similar tax credit phase-out applies until December 31, 2021, after which the tax credit scheme ends.

Trade association SEIA has long been on the frontline of this policy battle, and president and CEO Rhone Resch had much to say about this significant event:

“This historic vote brings the solar industry to the forefront of the conversation about American energy. The ITC extension makes America and its solar industry the world’s preeminent producer of clean and affordable energy.

“We commend members of Congress in both parties for taking this bold step and we look forward to delivering on the promise that this policy now offers all Americans.

“Thanks to the ITC, solar energy will add 220,000 new jobs by 2020, and with this extension, the solar industry can achieve its pledge of employing 50,000 veterans. Clean solar energy will cut emissions by 100 million metric tons and replace dozens of dirty power plants. Importantly, in the follow up to the Paris accord, this establishes the United States as a model for the reduction of greenhouse gases.

“A five-year extension of the ITC will lead to more than $133 billion in new, private sector investment in the U.S. economy by 2020. And much of this growth will come from small businesses, which make up more than 85% of America’s 8,000 solar companies.

“Solar power in this nation will more than triple by 2020, hitting 100 GW. That’s enough to power 20 million homes and represents 3.5% of U.S. electricity generation.

“The solar industry now has a seat at the table with the nation’s other major electricity producers. Solar is the planet’s most abundant source of energy and offers all Americans clean electricity that can be built at scale and will make our nation proud and prosperous as a world leader in a new energy paradigm.”

Analysis conducted just two weeks ago by IHS, prior to the extension of the ITC, forecast that U.S. solar installations would reach nearly 17 GWdc in 2016 driven by the rush from developers to finish projects ahead of the December 2016 ITC deadline. This would then lead to a drop to just 6.5 GW in 2017. The impact on the global solar industry would have been huge. IHS previously predicted global installations would peak at 70 GW in 2016 – a 20% increase over 2015 and largely driven by the huge demand from the United States; however, the cliff-edge in demand facing the country at the end of 2016 would have led to a global decline of 10% in 2017, with installations falling back to 63 GW.

This projected decline was based on a bottom-up assessment of more than 70 countries globally, based on known policy conditions. The effects of a sharp contraction in the United States was expected to be compounded by a stagnation of demand in China and Japan – both of which, like the U.S., had previously experience boom years.

The extension of the ITC for solar power projects — and the changed deadline criteria from “placed in production” to “started construction” — relieves the solar industry of the pressure to complete projects in 2016. For projects that are contracted to come into place by the end of 2016, IHS anticipates that developers will renegotiate the deadlines for the least advanced projects. The majority of pipeline projects that are not yet ready for construction are forecast to be completed after 2016, with peaks in 2020 to 2023. In parallel, the extension of tax-credits for residential PV enables steady growth of this segment through 2022.

Julia Hamm, president and CEO of SEPA, also released a statement:

“Our market research shows wide consumer interest in solar energy options, ranging from rooftop to community solar to utility-scale generation. The extension of the federal investment tax credit will allow for broader participation and deployment of these solar applications across the country, especially in regions where local markets are less mature. A robust solar sector can also accelerate the deployment of other distributed energy technologies — such as storage, demand response and energy efficiency — which will provide even more opportunities for creating value for both individual consumers and the grid as a whole.”

Read the original article on SolarPowerWorld.com -